How to Account for Mortgage Payments (2 Proven Methods for Landlords & Investors)

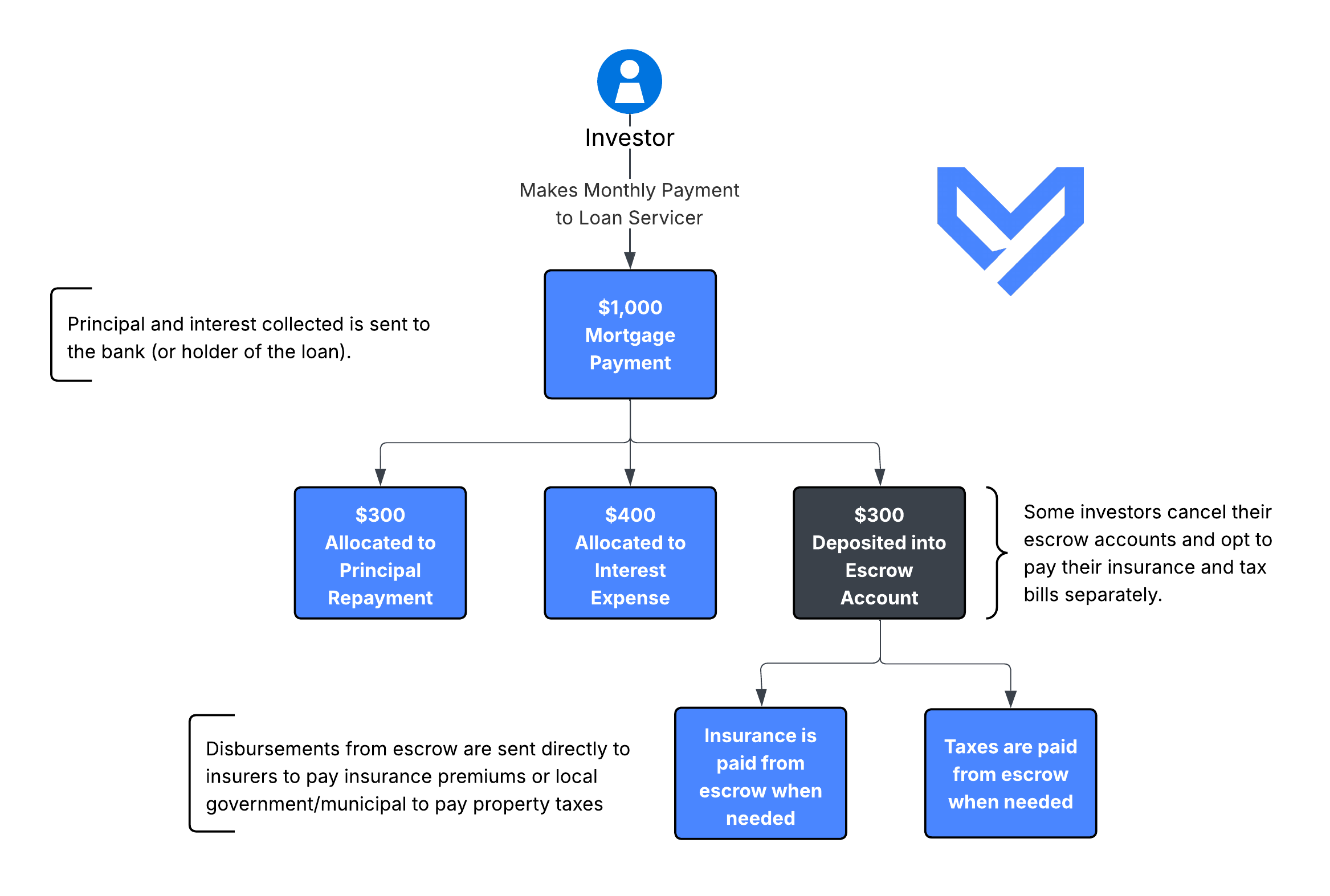

Figure Caption: This article makes it easy for landlords to track mortgage payments, whether you split each monthly transaction into principal, interest, and escrow (taxes and insurance), or reconcile everything before year-end. We’ll help provide clarity so you can confidently manage your books.

Managing rental property finances comes with plenty of moving parts—rent collection, expense tracking, and perhaps the trickiest of all: mortgage payments. If you’re using Baselane bookkeeping software to manage your real estate portfolio, you have two primary ways to record mortgage payments.

Both methods are accepted, but they come with different pros and cons depending on whether you value real-time accuracy or time savings during the year. In this article, we’ll walk through the two approaches step by step, explain when each makes sense, and give you tips on choosing the right one for your bookkeeping style.

Why Do Mortgage Payments Matter?

Before we dive into the two approaches, it’s important to understand why this choice matters. A monthly mortgage payment is not a single expense, it’s a bundle of financial components that behave differently for tax purposes, cash flow, and portfolio metrics. It generally includes:

Principal (or sometimes called Principal Repayment): This reduces your outstanding loan balance and builds equity over time. Principal is not a tax-deductible expense and does not show up on a tax return, but it matters for net worth and return metrics.

Interest (or sometimes called Interest Expense or Debt Service): This is a true operating expense and is generally deductible on tax return. Interest often represents the largest portion of a mortgage payment in the early years of the loan, especially in today’s interest rate environment, but gets reduced each month as the outstanding principal balance decreases through a process called amortization.

Taxes (or sometimes called Real Estate Taxes or Property Taxes and are typically escrowed): If escrowed, the loan servicer collects a portion each month and pays the local government or municipality on your behalf. Property taxes are tax deductible when paid, not when escrowed so it’s essential to accurately account for this properly. Typically, a loan servicer will issue an annual escrow analysis form that shows all disbursements from escrow in a given year. Additionally, this information is usually on a monthly statement as well.

Insurance (or sometimes call Landlord Dwelling Insurance or Real Estate Insurance and is typically escrowed): This can include landlord insurance to protect your real estate and/or mortgage insurance if you put less than a 20% downpayment on the loan. Insurance is typically tax deductible as a current year rental expense and is added to a tax return as an operating expense.

The takeaway here is that mortgage payments blur the line between cash flow, taxes, and performance returns and accurate bookkeeping makes a world of difference when it comes to having financial clarity and knowing what’s tax deductible or not.

Caption: The figure above shows a theoretical example of an investor making a $1,000 mortgage payment to a loan servicer and discusses the various components that make up the single mortgage payment.

Method 1: Splitting Each Monthly Mortgage Payment

This method treats each individual mortgage payment as a bundle of separate financial items rather than one lump-sum expense. It is the most accurate, accounting-compliant, and investor-friendly approach because it reveals what’s actually happening to your money each month (e.g., how much is building equity, how much is reducing taxable income, and how much is sitting in escrow for future insurance and tax bills).

How it Works in Baselane

Record the monthly mortgage payment when it clears your operating account. Typically, we like to set up a smart rule to do this.

Use the transaction split feature to divide the payment into its true components based on your mortgage statement provided by your loan servicer.

Save the transaction and Baselane automatically updates all relevant reporting.

Why Splitting Monthly Matters (The Investor Angle)

Mortgage payments are unique because they simultaneously impact:

Cash flow (money out the door each month)

Taxable income (through interest, taxes, and insurance deductions)

Balance sheet equity (through loan principal repayment)

Portfolio operations (escrow timing for taxes and insurance)

If you only track the mortgage as one number, you lose visibility into:

Your true operating expenses

Your NOI (Net Operating Income)

Your cash-on-cash return

Your principal paydown ROI

Your leveraged equity growth

Your DSCR (Debt Service Coverage Ratio)

For landlords who analyze deals, underwrite future acquisitions, or monitor performance across multiple doors, this granularity is extremely useful.

Advantages of Splitting Monthly

✔ Real-Time Financial Clarity

You immediately see how much of your payment is:

paying down debt,

reducing taxable income,

or sitting in escrow waiting to be spent.

This eliminates the common “rent minus mortgage” myth and replaces it with an actual investor-grade view.

✔ Accurate Cash Flow & Performance Reporting

Baselane’s dashboards reflect the true cost of operating a rental—not inflated by principal or distorted by escrow timing.

This becomes especially important if you:

report NOI to investors

track DSCR

evaluate refinancing opportunities

compare performance across markets or properties

✔ Smooth Tax Prep & CPA Hand-Off

Most of the Schedule E categorization is already done throughout the year.

By tax season, there’s no scramble to reconstruct mortgage splits or reference statements going back 12 months.

Our CPAs and bookkeepers at Vestora will love you for this! :D

Disadvantages of Splitting Monthly

✘ More Time-Intensive

Splitting takes a few extra clicks each month.

If you own multiple doors, or plan to, this becomes a recurring bookkeeping task.

✘ Requires Accurate Lender Information

You need the monthly breakdown from:

your mortgage statement,

online loan dashboard,

or amortization schedule.

Fortunately, most lenders provide this information digitally.

Best Fit For

Ideal for landlords who:

own multiple properties

are actively scaling their portfolio

track operating performance

report to partners or investors

use monthly insights to make decisions

engage in tax planning before year-end

This approach mirrors how institutional real estate investors, lenders, and fund accountants handle mortgage payments because it cleanly separates cash, expenses, and equity, rather than treating them as one number.

Method 2: Reconciling at Year-End (or Quarterly/Semi-Annual) With Manual Adjustments

The second approach opts for simplicity throughout the year and accuracy at the end of the reporting period. Instead of dissecting each mortgage payment into its components, you treat the payment as a single lump-sum transaction during the year and then make bookkeeping adjustments once you have the official annual numbers. This can be a perfectly valid approach for smaller portfolios or owners who aren’t actively using monthly performance data to make decisions.

How It Works in Baselane

Record each monthly mortgage payment and categorize it under a single label such as “Mortgage Payment.”

Skip monthly splits — no principal, interest, or escrow allocations needed during the year.

At year-end (or quarterly/semi-annually) once you receive lender documentation (typically Form 1098), create manual adjusting transactions for:

Total interest paid (Schedule E expense)

Property taxes paid (deductible if escrowed and remitted to the municipality)

Insurance / PMI premiums paid (deductible if escrowed and remitted)

Principal (loan balance adjustment, not deductible)

Form 1098 gives you definitive numbers for the year, ensuring tax accuracy without needing to maintain detailed splits every month.

Investor & Accounting Perspective

This method treats mortgage accounting the same way many DIY landlords treat taxes—“we’ll sort it out at the end of the year.” It smooths out the monthly workload but sacrifices interim visibility into:

True operating expenses

Principal vs. interest splits

Cash flow vs. net income differences

Accrual vs. escrow timing

Reserve and DSCR health

Equity growth via principal paydown

In practice, this approach is well-aligned with landlords who aren’t using their books to make monthly operating or acquisition decisions.

Advantages of Year-End Reconciliation

✔ Faster Month-to-Month Bookkeeping

Only one category per mortgage payment. No splits, no amortization schedules, no portal lookups.

✔ Simple for Single-Property Landlords

If you only track performance annually, monthly details may not be worth the time investment.

✔ Relies on Official Documents

Form 1098 provides interest and tax numbers straight from the lender — CPA-friendly and audit-safe.

✔ Less Friction for New Investors

This is often the method used before a landlord scales or begins treating properties as a business.

Disadvantages of Year-End Reconciliation

✘ Less Accurate Financial Reporting Throughout the Year

Baselane’s dashboards will temporarily overstate operating expenses and understate equity paydown until adjustments are entered.

✘ No Real-Time Performance Insights

Metrics like NOI, cash flow, and paydown ROI are distorted until year-end cleanup.

✘ Heavier Year-End Workload

If you wait until tax season, adjustments can pile up and create stress — especially if you're also gathering receipts, depreciation schedules, or CPA documents.

✘ Harder to Make Strategic Decisions

Refinances, acquisitions, and rental pricing decisions benefit from accurate interim data. This approach delays those insights.

Best Fit For

Ideal for landlords who:

own 1–2 properties

focus on year-end tax reporting

make few mid-year financial decisions

prefer simplicity over precision

haven’t yet scaled to investor-style analysis

This method is also common among landlords who plan to graduate to Method 1 as their portfolio or sophistication grows.

Side-by-Side Comparison: Splitting vs. Reconciling

Compare the two common approaches to recording mortgage payments in Baselane. On mobile, this table becomes easy-to-scan cards.

| Feature | Split Monthly Payments | Year-End Reconciliation |

|---|---|---|

| What it is | Break each monthly payment into principal, interest, property taxes, and insurance using Baselane’s split transaction feature. | Record one monthly “Mortgage” payment during the year, then make manual adjusting entries at year-end from Form 1098 (interest) and your escrow totals (taxes/insurance) plus principal to loan balance. |

| Accuracy | High — real-time clarity every month. | Deferred — low during the year, accurate after adjustments. |

| Time commitment | Ongoing monthly splitting; moderate effort. | Very low during the year; higher at tax time. |

| Tax prep | Mostly done already; clean Schedule E export. | Requires manual year-end entries from 1098/escrow statements. |

| Best for | Multi-property investors, partners, and growth-focused landlords who want monthly performance visibility. | One or two properties, owners prioritizing simplicity and only caring about year-end results. |

| Pros |

|

|

| Cons |

|

|

| Baselane steps |

|

|

| Consistency tip | Use the same categories and naming across all properties Recommended | Document your year-end workflow and repeat it annually |

Tip: Pick one method and apply it consistently across properties for cleaner books and faster reporting.

Which Method Should You Choose?

Choosing between monthly splitting and year-end reconciliation depends on how actively you manage your portfolio and what you need your books to tell you throughout the year. Both methods are valid — the difference is how much visibility and precision you want between January and December.

If you want real-time clarity — meaning you care about monthly cash flow, NOI, principal paydown, or performance metrics — then splitting each payment is worth the extra clicks. This method transforms your bookkeeping into an investor tool, not just a tax tool.

If you mainly care about tax accuracy once a year, and you don’t rely on interim financial data to make decisions, then year-end reconciliation is perfectly fine. You’ll spend less time during the year and clean things up once Form 1098 arrives.

How to Decide (Practical Investor Criteria)

Ask yourself:

How many properties do I have?

Do I make financial decisions mid-year (refi, acquisitions, pricing)?

Do I report to partners, lenders, or investors?

Do I track performance and cash flow monthly or quarterly?

Am I planning to scale?

Portfolio size and intent matter here. A landlord with a single long-term rental may not need monthly NOI tracking. A landlord buying two new properties a year almost certainly will.

Our Recommendation

At Vestora, we generally recommend monthly splitting for landlords with multiple properties, partners, or scale ambitions. Consistency matters when you’re comparing performance across units, preparing investor updates, underwriting acquisitions, or tracking DSCR for a refinance.

But for newer or smaller landlords — especially those with one or two doors — year-end adjustments are more than enough. If you’re still in the “learn and optimize” phase rather than the “operate and scale” phase, simplicity often wins.

A Helpful Rule of Thumb

Operate as a business → Split monthly

File for taxes → Reconcile annually

Both methods are acceptable — the key is alignment with your goals, not perfection.

Final Thoughts

When it comes to accounting for mortgage payments in Baselane, there’s no one-size-fits-all method. The important part is consistency. Pick an approach and apply it across your properties so your bookkeeping stays clean, comparable, and tax-ready.

Baselane gives landlords the flexibility to operate either way. If you value real-time performance visibility, detailed monthly splitting keeps you informed throughout the year. If you prefer simpler workflows and primarily care about taxes at year-end, reconciliation with Form 1098 is a perfectly valid alternative. The platform adapts to your style, your scale, and your goals as a landlord.

If you want more support, guidance, or done-for-you bookkeeping and tax help, Vestora offers service designed specifically for real estate investors and landlords, including monthly bookkeeping, entity-level advisory, and integrated tax preparation. You can explore those service offerings here to see what level of support fits your portfolio and where you are in your investing journey.

We’re also constantly improving our content and resources for landlords. If you have feedback on this guide, or ideas for what you’d like to see next, we’d love to hear from you. Sharing your experience helps shape what we build next.